AIGC expands footprint in Chinese film industry, enhancing efficiency, creativity

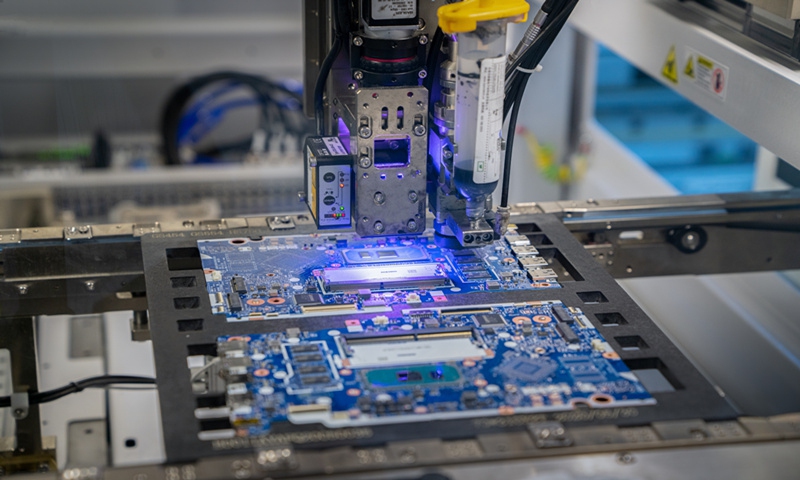

The integration of AI-generated content (AIGC) into the film industry has taken a step forward with the launch of the Kling AI "Movie Co-Creation Project" on Monday. This initiative brings together nine prominent Chinese directors, including Li Shaohong and Yu Baimei, to create nine short films using AIGC. It marks China's first large-scale effort to apply AI-powered video-generation models to cinematic content creation.

Kling AI's ability to generate videos from images, control motion, and manage camera angles not only enhances production efficiency but also elevates the quality of cinematic output. The platform's broader application potential underscores its significance beyond experimental projects.

The technology's importance is further highlighted by the Beijing International Film Festival's recent announcement of its first AIGC filmmaking course. This course is designed to equip new filmmakers with the skills to integrate AI technology into the creative process, blending technical expertise with emotional storytelling.

"Technological innovation has always been part of cinema's evolution," Shi Wenxue, a veteran film critic and a preliminary judge in the main competition section at the Beijing International Film Festival, told the Global Times on Tuesday.

He emphasized how tools like AIGC are accelerating the filmmaking process by streamlining scriptwriting and project planning.

"Many of my colleagues are primarily using AIGC for technical tasks like previs (previsualization). Previously, we had to build preview models using tools like LEGO blocks; now AIGC offers a more direct and effective solution," Shi noted.

While AIGC excels in certain film genres such as animation, sci-fi, and archaeology-themed productions, Shi also noted that it is unlikely to fully replace human creativity or the emotional depth that actors and filmmakers bring to their work.

"AIGC serves as a support tool rather than a core replacement in the filmmaking process," Shi said.

Major players in the film industry have already begun to recognize the advantages offered by AIGC. Domestically, productions like the short narrative series Sanxingdui: Future Apocalypse, and CCTV's fully AI-produced micro film Chinese Mythology demonstrate how AI is driving advancements in the domestic film sector, particularly in the emerging micro drama industry.

Internationally, the influence of AIGC is also growing. Glenn Marshall, an AI artist, won the Jury Award at the 2022 Cannes Short Film Festival with his AI-generated film The Crow, highlighting the global reach and recognition of AI's role in creative content creation.

It's worth noting that the rise of AIGC has also sparked debate, particularly in industries that traditionally rely on human creativity. The 2023 Hollywood strikes, initially targeting employees' benefits, were also driven by concerns that AI could replace human roles, with issues around compensation and job security taking center stage.

"Don't see them as competitors or enemies; they are your work partners. Every technological breakthrough has benefited artistic creation, allowing creators' visions to be realized more perfectly and accurately. At the same time, AI also places higher demands on film professionals - they must have ideas that surpass it," Chinese director Liu Jiacheng said in an interview with the Xinhua News Agency.

Experts say as AIGC continues to develop, it will drive the next wave of innovation in the film industry. Its ability to enhance productivity and reduce costs could unlock a new era of efficiency, particularly in the rapidly expanding micro drama sector.